Prince George County Single Family Dwelling Rental, Security Deposit, Interest, Escrow

A security is a tradable financial asset. The term commonly refers to any form of financial musical instrument, but its legal definition varies by jurisdiction. In some countries and languages people normally use the term "security" to refer to any form of financial instrument, fifty-fifty though the underlying legal and regulatory authorities may not take such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, east.yard., disinterestedness warrants.

Securities may be represented by a document or, more typically, they may be "non-certificated", that is in electronic (dematerialized) or "volume entry simply" course. Certificates may be bearer, meaning they entitle the holder to rights nether the security just by property the security, or registered, pregnant they entitle the holder to rights only if he or she appears on a security annals maintained by the issuer or an intermediary. They include shares of corporate stock or mutual funds, bonds issued by corporations or governmental agencies, stock options or other options, limited partnership units, and various other formal investment instruments that are negotiable and fungible.

U.k. and United States [edit]

In the United Kingdom, the Financial Acquit Authority functions equally the national competent say-so for the regulation of financial markets; the definition in its Handbook of the term "security"[ane] applies just to equities, debentures, alternative debentures, regime and public securities, warrants, certificates representing sure securities, units, stakeholder pension schemes, personal alimony schemes, rights to or interests in investments, and anything that may be admitted to the Official Listing.

In the Usa, a "security" is a tradable financial asset of any kind.[2] Securities can be broadly categorized into:

- debt securities (e.g., banknotes, bonds, and debentures)

- equity securities (eastward.k., mutual stocks)

- derivatives (due east.g., forrad, futures, options, and swaps).

The company or other entity issuing the security is called the issuer. A land's regulatory structure determines what qualifies equally a security. For example, private investment pools may have some features of securities, only they may not be registered or regulated every bit such if they meet diverse restrictions.

Securities are the traditional method that commercial enterprises use to raise new upper-case letter. They may offering an attractive culling to depository financial institution loans - depending on their pricing and market demand for item characteristics. A disadvantage of bank loans as a source of financing is that the bank may seek a mensurate of protection against default by the borrower via extensive financial covenants. Through securities, capital is provided past investors who buy the securities upon their initial issuance. In a similar fashion, a government may issue securities when it chooses to increase government debt.

Debt and equity [edit]

Securities are traditionally divided into debt securities and equities (see also derivatives).

Debt [edit]

Debt securities may be called debentures, bonds, deposits, notes or commercial paper depending on their maturity, collateral and other characteristics. The holder of a debt security is typically entitled to the payment of chief and interest, together with other contractual rights nether the terms of the consequence, such as the right to receive certain information. Debt securities are more often than not issued for a fixed term and redeemable by the issuer at the end of that term. Debt securities may be protected by collateral or may be unsecured, and, if they are unsecured, may exist contractually "senior" to other unsecured debt significant their holders would have a priority in a defalcation of the issuer. Debt that is non senior is "subordinated".

Corporate bonds represent the debt of commercial or industrial entities. Debentures have a long maturity, typically at to the lowest degree ten years, whereas notes have a shorter maturity. Commercial paper is a elementary form of debt security that essentially represents a mail-dated cheque with a maturity of non more than 270 days.

Money market instruments are short term debt instruments that may take characteristics of deposit accounts, such as certificates of eolith, Accelerated Return Notes (ARN), and certain bills of substitution. They are highly liquid and are sometimes referred to as "near cash". Commercial paper is also oft highly liquid.

Euro debt securities are securities issued internationally outside their domestic market in a denomination dissimilar from that of the issuer's domicile. They include eurobonds and euronotes. Eurobonds are characteristically underwritten, and not secured, and interest is paid gross. A euronote may accept the form of euro-commercial paper (ECP) or euro-certificates of deposit.

Regime bonds are medium or long term debt securities issued by sovereign governments or their agencies. Typically they bear a lower rate of interest than corporate bonds, and serve as a source of finance for governments. U.S. federal authorities bonds are chosen treasuries. Because of their liquidity and perceived low gamble, treasuries are used to manage the money supply in the open up market operations of non-US central banks.

Sub-sovereign government bonds, known in the U.Southward. as municipal bonds, represent the debt of land, provincial, territorial, municipal or other governmental units other than sovereign governments.

Supranational bonds represent the debt of international organizations such equally the Globe Banking company[ citation needed ], the International Budgetary Fund[ citation needed ], regional multilateral evolution banks[ vague ] and others.

Equity [edit]

An equity security is a share of disinterestedness interest in an entity such as the capital stock of a company, trust or partnership. The most common form of equity interest is common stock, although preferred disinterestedness is as well a grade of capital stock. The holder of an equity is a shareholder, owning a share, or fractional part of the issuer. Unlike debt securities, which typically require regular payments (involvement) to the holder, equity securities are not entitled to any payment. In bankruptcy, they share but in the residual interest of the issuer after all obligations have been paid out to creditors. Still, equity generally entitles the holder to a pro rata portion of control of the company, meaning that a holder of a majority of the disinterestedness is usually entitled to control the issuer. Equity also enjoys the right to profits and capital gain, whereas holders of debt securities receive merely involvement and repayment of master regardless of how well the issuer performs financially. Furthermore, debt securities do non take voting rights outside of bankruptcy. In other words, equity holders are entitled to the "upside" of the business and to control the business.

Hybrid [edit]

Hybrid securities combine some of the characteristics of both debt and disinterestedness securities.

Preference shares form an intermediate class of security between equities and debt. If the issuer is liquidated, they behave the right to receive interest or a return of capital in priority to ordinary shareholders. However, from a legal perspective, they are upper-case letter stock and therefore may entitle holders to some degree of control depending on whether they contain voting rights.

Convertibles are bonds or preferred stock that can exist converted, at the election of the holder of the convertibles, into the mutual stock of the issuing company. The convertibility, all the same, may exist forced if the convertible is a callable bond, and the issuer calls the bail. The bondholder has almost 1 calendar month to convert it, or the company will telephone call the bond by giving the holder the call cost, which may exist less than the value of the converted stock. This is referred to as a forced conversion.

Equity warrants are options issued by the company that allow the holder of the warrant to purchase a specific number of shares at a specified cost inside a specified fourth dimension. They are often issued together with bonds or existing equities, and are, sometimes, detachable from them and separately tradeable. When the holder of the warrant exercises it, he pays the money directly to the company, and the company problems new shares to the holder.

Warrants, like other convertible securities, increases the number of shares outstanding, and are always accounted for in financial reports as fully diluted earnings per share, which assumes that all warrants and convertibles will exist exercised.

Classification [edit]

Securities may be classified according to many categories or nomenclature systems:

- Currency of denomination

- Ownership rights

- Terms to maturity

- Caste of liquidity

- Income payments

- Revenue enhancement treatment

- Credit rating

- Industrial sector or "industry". ("Sector" frequently refers to a higher level or broader category, such as Consumer Discretionary, whereas "industry" frequently refers to a lower level nomenclature, such as Consumer Appliances. See Industry for a discussion of some classification systems.)

- Region or country (such as state of incorporation, country of principal sales/market of its products or services, or state in which the principal securities substitution where it trades is located)

- Marketplace capitalization

- Country (typically for municipal or "revenue enhancement-free" bonds in the US)

Type of holder [edit]

Investors in securities may exist retail, i.e., members of the public investing personally, other than by way of business.

In stardom, the greatest part of investment in terms of volume, is wholesale, i.e., past financial institutions acting on their own account, or on behalf of clients. Of import institutional investors include investment banks, insurance companies, pension funds and other managed funds. The "wholesaler" is typically an underwriter or a broker-dealer who trades with other banker-dealers, rather than with the retail investor.[3]

This stardom carries over to banking; compare Retail banking and Wholesale cyberbanking.

Investment [edit]

The traditional economic office of the purchase of securities is investment, with the view to receiving income or achieving capital letter gain. Debt securities generally offering a college rate of interest than banking company deposits, and equities may offer the prospect of capital growth. Equity investment may also offering control of the business of the issuer. Debt holdings may as well offer some measure of control to the investor if the company is a fledgling outset-upwardly or an sometime behemothic undergoing 'restructuring'. In these cases, if interest payments are missed, the creditors may take control of the company and liquidate it to recover some of their investment.

Collateral [edit]

The last decade has seen an enormous growth in the utilise of securities as collateral. Purchasing securities with borrowed money secured by other securities or cash itself is called "buying on margin". Where A is owed a debt or other obligation by B, A may crave B to evangelize property rights in securities to A, either at inception (transfer of championship) or only in default (non-transfer-of-title institutional). For institutional loans, property rights are not transferred but still enable A to satisfy its claims in case B fails to make adept on its obligations to A or otherwise becomes insolvent. Collateral arrangements are divided into two wide categories, namely security interests and outright collateral transfers. Commonly, commercial banks, investment banks, authorities agencies and other institutional investors such as mutual funds are significant collateral takers too as providers. In addition, individual parties may utilize stocks or other securities as collateral for portfolio loans in securities lending scenarios.

On the consumer level, loans against securities have grown into three distinct groups over the terminal decade: 1) Standard Institutional Loans, mostly offering low loan-to-value with very strict call and coverage regimens, akin to standard margin loans; 2) Transfer-of-Title (ToT) Loans, typically provided past private parties where borrower ownership is completely extinguished relieve for the rights provided in the loan contract; and 3) Non-Transfer-of-Championship Credit Line facilities where shares are not sold and they serve as assets in a standard lien-type line of greenbacks credit. Of the three, transfer-of-title loans have fallen into the very high-hazard category as the number of providers has dwindled as regulators have launched an industry-wide crackdown on transfer-of-title structures where the individual lender may sell or sell short the securities to fund the loan. Institutionally managed consumer securities-based loans on the other hand, draw loan funds from the financial resources of the lending institution, not from the auction of the securities.

Collateral and sources of collateral are changing, in 2012 gold became a more than acceptable form of collateral.[4] However more recently Exchange-traded funds (ETFs) seen by many as the ugly ducklings of the collateral world have started to get more than readily available and acceptable.[5] Merely in a world where collateral is becoming scarce and efficiency is everything, many of these mallards are proving themselves to exist not so ugly after all—many more are veritable swans. The problem, until at present, for collateral managers has been deciphering the bad eggs from the good, which proves to be a fourth dimension-consuming and inefficient task.

Markets [edit]

Primary and secondary market [edit]

Public securities markets are either primary or secondary markets. In the primary market, the money for the securities is received by the issuer of the securities from investors, typically in an initial public offering (IPO). In the secondary market, the securities are simply assets held by 1 investor selling them to another investor, with the money going from 1 investor to the other.

An initial public offering is when a company problems public stock newly to investors, chosen an "IPO" for curt. A visitor can later consequence more new shares, or effect shares that have been previously registered in a shelf registration. These later new problems are also sold in the primary marketplace, but they are not considered to be an IPO merely are often called a "secondary offering". Issuers unremarkably retain investment banks to assist them in administering the IPO, obtaining SEC (or other regulatory body) approval of the offering filing, and selling the new issue. When the investment bank buys the entire new issue from the issuer at a discount to resell it at a markup, it is called a firm delivery underwriting. However, if the investment banking company considers the risk also nifty for an underwriting, it may just assent to a best effort agreement, where the investment bank will simply do its all-time to sell the new issue.

For the principal marketplace to thrive, there must be a secondary marketplace, or aftermarket that provides liquidity for the investment security—where holders of securities tin sell them to other investors for cash. Otherwise, few people would purchase chief bug, and, thus, companies and governments would be restricted in raising disinterestedness capital (money) for their operations. Organized exchanges establish the main secondary markets. Many smaller issues and most debt securities trade in the decentralized, dealer-based over-the-counter markets.

In Europe, the principal trade organization for securities dealers is the International Capital Marketplace Association.[half dozen] In the U.Due south., the principal trade organization for securities dealers is the Securities Industry and Financial Markets Clan,[7] which is the result of the merger of the Securities Industry Association and the Bail Marketplace Association. The Financial Information Services Division of the Software and Information Manufacture Association (FISD/SIIA)[8] represents a round-tabular array of market data industry firms, referring to them every bit Consumers, Exchanges, and Vendors. In Republic of india the equivalent organisation is the securities exchange board of India (SEBI).

Public offer and individual placement [edit]

In the primary markets, securities may be offered to the public in a public offering. Alternatively, they may be offered privately to a limited number of qualified persons in a individual placement. Sometimes a combination of the two is used. The stardom between the two is important to securities regulation and company law. Privately placed securities are not publicly tradable and may only be bought and sold by sophisticated qualified investors. As a result, the secondary market is not nearly as liquid as it is for public (registered) securities.

Some other category, sovereign bonds, is generally sold past sale to a specialized class of dealers.

List and over-the-counter dealing [edit]

Securities are often listed in a stock substitution, an organized and officially recognized marketplace on which securities can be bought and sold. Issuers may seek listings for their securities to concenter investors, by ensuring there is a liquid and regulated market that investors tin buy and sell securities in.

Growth in breezy electronic trading systems has challenged the traditional business of stock exchanges. Large volumes of securities are likewise bought and sold "over the counter" (OTC). OTC dealing involves buyers and sellers dealing with each other by phone or electronically on the basis of prices that are displayed electronically, usually by fiscal data vendors such as SuperDerivatives, Reuters, Investing.com and Bloomberg.

At that place are also eurosecurities, which are securities that are issued outside their domestic market into more than than ane jurisdiction. They are generally listed on the Luxembourg Stock Commutation or admitted to listing in London. The reasons for listing eurobonds include regulatory and tax considerations, as well as the investment restrictions.

Securities services [edit]

Securities Services refers to the products and services that are offered to institutional clients that issue, trade, and concur securities. The bank engaged in securities services are usually called a custodian bank. Market players include BNY Mellon, J.P. Morgan, HSBC, Citi, BNP Paribas, Société Générale etc.

Market [edit]

London is the heart of the eurosecurities markets. At that place was a huge rising in the eurosecurities market in London in the early 1980s. Settlement of trades in eurosecurities is currently effected through two European computerized clearing/depositories called Euroclear (in Belgium) and Clearstream (formerly Cedelbank) in Luxembourg.

The main market for Eurobonds is the EuroMTS, owned by Borsa Italiana and Euronext. At that place are ramp upwards market in Emergent countries, just information technology is growing slowly.

Physical nature [edit]

Certificated securities [edit]

Securities that are represented in paper (physical) form are called certificated securities. They may be bearer or registered.

DRS securities [edit]

Securities may also exist held in the Directly Registration System (DRS), which is a method of recording shares of stock in book-entry course. Book-entry means the company's transfer agent maintains the shares on the owner's behalf without the need for physical share certificates. Shares held in un-certificated book-entry form have the same rights and privileges as shares held in certificated form.

Bearer securities [edit]

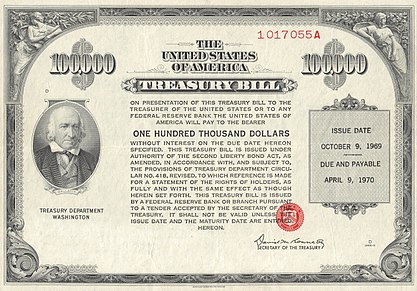

1969 $100,000 Treasury Bill

Bearer securities are completely negotiable and entitle the holder to the rights under the security (e.g., to payment if it is a debt security, and voting if information technology is an equity security). They are transferred by delivering the instrument from person to person. In some cases, transfer is by endorsement, or signing the back of the musical instrument, and delivery.

Regulatory and fiscal authorities sometimes regard bearer securities negatively, as they may be used to facilitate the evasion of regulatory restrictions and tax. In the U.k., for case, the issue of bearer securities was heavily restricted firstly by the Substitution Control Act 1947 until 1953. Bearer securities are very rare in the United States because of the negative revenue enhancement implications they may have to the issuer and holder.

In Luxembourg, the law of 28 July 2014 concerning the compulsory eolith and immobilization of shares and units in bearer grade adopts the compulsory eolith and immobilization of bearer shares and units with a depositary allowing identification of the holders thereof.

Registered securities [edit]

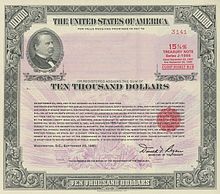

1981 $ten,000 15.875% Registered Notation

In the instance of registered securities, certificates bearing the name of the holder are issued, merely these merely correspond the securities. A person does not automatically acquire legal buying by having possession of the certificate. Instead, the issuer (or its appointed agent) maintains a annals in which details of the holder of the securities are entered and updated as appropriate. A transfer of registered securities is effected past amending the annals.

Not-certificated securities and global certificates [edit]

Modern practice has developed to eliminate both the need for certificates and maintenance of a complete security register past the issuer. There are two general means this has been accomplished.

Not-certificated securities [edit]

In some jurisdictions, such as France, it is possible for issuers of that jurisdiction to maintain a legal tape of their securities electronically.

In the United states of america, the current "official" version of Commodity viii of the Uniform Commercial Code permits not-certificated securities. However, the "official" UCC is a mere draft that must be enacted individually by each U.S. country. Though all 50 states (likewise as the District of Columbia and the U.Southward. Virgin Islands) accept enacted some form of Commodity 8, many of them still announced to employ older versions of Commodity 8, including some that did not permit non-certificated securities.[9]

Global certificates, book entry interests, depositories [edit]

To facilitate the electronic transfer of interests in securities without dealing with inconsistent versions of Commodity 8, a system has developed whereby issuers eolith a single global certificate representing all the outstanding securities of a grade or serial with a universal depository. This depository is called The Depository Trust Company, or DTC. DTC's parent, Depository Trust & Immigration Corporation (DTCC), is a non-profit cooperative owned by approximately thirty of the largest Wall Street players that typically act as brokers or dealers in securities. These thirty banks are called the DTC participants. DTC, through a legal nominee, owns each of the global securities on behalf of all the DTC participants.

All securities traded through DTC are in fact held, in electronic form, on the books of various intermediaries between the ultimate owner, e.g., a retail investor, and the DTC participants. For example, Mr. Smith may concord 100 shares of Coca-Cola, Inc. in his brokerage account at local banker Jones & Co. brokers. In turn, Jones & Co. may concur one thousand shares of Coca-Cola on behalf of Mr. Smith and nine other customers. These 1000 shares are held past Jones & Co. in an business relationship with Goldman Sachs, a DTC participant, or in an business relationship at some other DTC participant. Goldman Sachs in turn may hold millions of Coca-Cola shares on its books on behalf of hundreds of brokers like to Jones & Co. Each day, the DTC participants settle their accounts with the other DTC participants and adjust the number of shares held on their books for the benefit of customers similar Jones & Co. Ownership of securities in this fashion is called beneficial buying. Each intermediary holds on behalf of someone beneath him in the chain. The ultimate owner is chosen the beneficial owner. This is also referred to every bit owning in "Street proper name".

Amidst brokerages and mutual fund companies, a big corporeality of mutual fund share transactions have place amongst intermediaries as opposed to shares being sold and redeemed directly with the transfer agent of the fund. Most of these intermediaries such as brokerage firms articulate the shares electronically through the National Securities Clearing Corp. or "NSCC", a subsidiary of DTCC.

Other depositories [edit]

Besides DTC, two other large securities depositories exist, both in Europe: Euroclear and Clearstream.

Divided and undivided security [edit]

The terms "divided" and "undivided" chronicle to the proprietary nature of a security.

Each divided security constitutes a separate asset, which is legally distinct from each other security in the same issue. Pre-electronic bearer securities were divided. Each instrument constitutes the separate covenant of the issuer and is a separate debt.

With undivided securities, the entire upshot makes upward ane unmarried nugget, with each of the securities being a partial part of this undivided whole. Shares in the secondary markets are ever undivided. The issuer owes merely ane fix of obligations to shareholders under its memorandum, articles of association and company police force. A share represents an undivided fractional role of the issuing company. Registered debt securities besides take this undivided nature.

Fungible and non-fungible securities [edit]

In a fungible security, all holdings of the security are treated identically and are interchangeable.

Sometimes securities are non fungible with other securities, for case unlike series of bonds issued by the same company at dissimilar times with different conditions attaching to them.

Regulation [edit]

In the The states, the public offer and sale of securities must be either registered pursuant to a registration argument that is filed with the U.S. Securities and Exchange Commission (SEC) or are offered and sold pursuant to an exemption therefrom. Dealing in securities is regulated by both federal regime (SEC) and state securities departments. In addition, the brokerage industry is supposedly self policed past self-regulatory organizations (SROs), such as the Financial Industry Regulatory Potency (FINRA), formerly the National Association of Securities Dealers (or NASD), or the Municipal Securities Rulemaking Board (MSRB).

With respect to investment schemes that exercise not fall within the traditional categories of securities listed in the definition of a security (Sec. 2(a)(1) of the Securities Act of 1933 and Sec. 3(a)(10) of the 34 act) the The states Courts have adult a broad definition for securities that must and so be registered with the SEC. When determining if there is an "investment contract" that must be registered the courts look for an investment of money, a common enterprise and expectation of profits to come primarily from the efforts of others. See SEC five. W.J. Howey Co.

See also [edit]

- Commercial law

- Finance

- Financial market

- Fiscal regulation

- History of private equity and venture upper-case letter

- Interest in securities

- List of finance topics

- Securities analyst

- Securities lending

- Securities regulation in the Us

- Settlement (finance)

- Single-stock futures

- Stock market information systems

- T2S

- Toxic security

- Trading business relationship avails

References [edit]

- ^ "security", FCA Handbook, Financial Behave Dominance, retrieved 2016-11-11

- ^ The United States Securities Exchange Act of 1934 defines a security as:

"Whatsoever note, stock, treasury stock, bond, debenture, certificate of interest or participation in any turn a profit-sharing agreement or in any oil, gas, or other mineral royalty or lease, any collateral trust document, preorganization document or subscription, transferable share, investment contract, voting-trust certificate, document of eolith, for a security, any put, call, straddle, choice, or group or index of securities (including any interest therein or based on the value thereof), or any put, call, straddle, option, or privilege entered into on a national securities substitution relating to foreign currency, or in general, whatever instrument normally known as a 'security'; or any document of involvement or participation in, temporary or interim certificate for, receipt for, or warrant or right to subscribe to or buy, whatsoever of the foregoing; but shall not include currency or whatever note, draft, neb of exchange, or banker'due south credence which has a maturity at the time of issuance of non exceeding nine months, exclusive of days of grace, or any renewal thereof the maturity of which is likewise limited."

- ^ "Wholesaler", Hypertextual Finance Glossary (Campbell Harvey)

- ^ "CME Clearing Europe collateral types to include gold bullion | Securities Lending Times news | securitieslendingtimes.com". world wide web.securitieslendingtimes.com. Retrieved 2015-12-17 .

- ^ "Markit makes its ETF mark with big market players | Securities Lending Times news | securitieslendingtimes.com". world wide web.securitieslendingtimes.com. Retrieved 2015-12-17 .

- ^ "icma-group.org". icma-group.org. Retrieved 2012-05-xviii .

- ^ "sifma.org". sifma.org. 2012-05-x. Retrieved 2012-05-xviii .

- ^ "fisd.net". fisd.net. Retrieved 2012-05-18 .

- ^ "LII: UCC - Locator". Law.cornell.edu. 2004-03-15. Retrieved 2012-04-24 .

Source: https://en.wikipedia.org/wiki/Security_(finance)

0 Response to "Prince George County Single Family Dwelling Rental, Security Deposit, Interest, Escrow"

Postar um comentário